Easily Checking Your Cibil Score Online 2022: A How-To Guide

Understanding Credit Scores

Defining Credit Scores: An Overview

A credit score is a numerical representation of an individual’s creditworthiness. It is used by lenders, landlords, and other financial institutions to assess the risk of extending credit or a loan to a borrower.

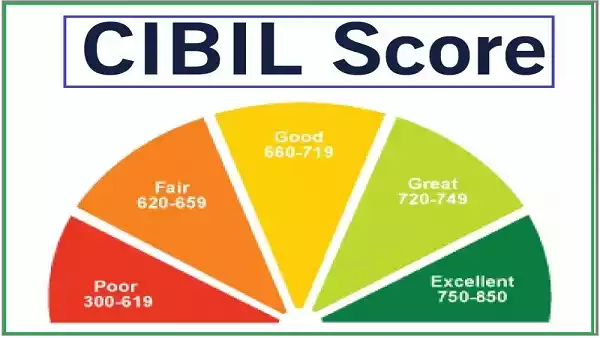

A credit score is calculated based on an individual’s credit history, which includes information about their borrowing and repayment habits. A high credit score indicates that an individual has a good credit history and is likely to be a low-risk borrower, while a low credit score may indicate that an individual has a poor credit history and is considered a higher risk. Credit scores are typically measured on a scale of 300 to 850, with higher scores indicating lower risk.

UIDAI NISG New Recruitment 2022 – Annual Salary Rs. 6,00,000/- | Apply in complete details below!

A credit score is an important factor that lenders consider when determining whether to approve a loan or credit application, and it can also affect the interest rate and terms that are offered to a borrower.

The Importance of Credit Scores in Financial Decision Making

Credit scores are important because they are used by lenders, landlords, and other financial institutions to assess the risk of extending credit or a loan to a borrower.

A high credit score indicates that an individual has a good credit history and is likely to be a low-risk borrower, while a low credit score may indicate that an individual has a poor credit history and is considered a higher risk.

As a result, a person’s credit score can have a significant impact on their ability to borrow money, rent an apartment, or get approved for certain types of insurance.

In addition, credit scores can affect the terms and interest rates that are offered to a borrower. Individuals with higher credit scores may be offered more favorable terms, such as lower interest rates, while those with lower credit scores may be offered less favorable terms or may be denied credit altogether.

Overall, credit scores are important because they help to determine an individual’s creditworthiness and can have a significant impact on their financial well-being.

What factors influence an individual’s Credit Score?

There are several factors that can affect an individual’s credit score. Some of the main factors include:

Payment history: Payment history is a major factor that affects credit scores. Making on-time payments on credit accounts demonstrates responsible borrowing and can help to improve a credit score. Late or missed payments, on the other hand, can have a negative impact on a credit score.

Credit utilization: Credit utilization is the amount of credit that an individual is using compared to their available credit limit. A high credit utilization ratio (using a large percentage of available credit) can have a negative impact on a credit score, while a low credit utilization ratio (using a small percentage of available credit) can help to improve a credit score.

Indian travellers from Emirates are recommended to bring their authentic Emirates ID.

Length of credit history: The longer an individual has a credit history, the better their credit score is likely to be. This is because a longer credit history can provide more information to credit scoring systems about an individual’s borrowing and repayment habits.

Credit mix: Credit mix refers to the variety of credit accounts that an individual has, such as credit cards, mortgages, and car loans. A diverse credit mix can help to improve a credit score, as it shows that an individual can handle different types of credit responsibly.

New credit: Applying for new credit can have a negative impact on a credit score, as it may indicate that an individual is taking on more debt. However, opening a new credit account and using it responsibly can help to improve a credit score over time.

What steps can be taken to improve Credit Score?

There are several steps that individuals can take to improve their credit scores:

- Pay bills on time: Making on-time payments on credit accounts is one of the most important factors in determining a credit score. Paying bills on time demonstrates responsible borrowing and can help to improve a credit score.

- Keep balances low: High balances on credit cards can have a negative impact on a credit score. Try to keep balances low and pay off as much as possible each month.

- Don’t close old accounts: Closing old credit accounts can have a negative impact on a credit score because it reduces the overall amount of credit available. Instead, try to use old accounts responsibly and pay off balances in full each month.

- Don’t open too many new accounts at once: Applying for new credit can have a negative impact on a credit score, as it may indicate that an individual is taking on more debt. Try to limit the number of new credit accounts that you open.

- Monitor credit reports: Credit reports can contain errors that can negatively impact a credit score. Regularly review your credit reports to ensure that the information is accurate and address any errors that you find.

By following these steps and using credit responsibly, individuals can work to improve their credit scores over time.

What is the process for checking Cibil Score online?

To check your Cibil Score online, you will need to follow these steps:

- Visit the Cibil website (www.cibil.com).

- Click on the “Check Your Score” button on the homepage.

- Enter your personal and contact information on the form provided. This may include your name, date of birth, email address, and mobile number.

- Read and accept the terms and conditions of the service.

- Click on the “Submit” button to proceed.

- Follow the prompts to complete the identity verification process. This may involve entering additional information or providing documents to confirm your identity.

- Once your identity has been verified, you will be able to view your Cibil Score online.

Note: To check your Cibil Score online, you may be required to pay a fee. The cost of this service will vary depending on the package that you choose.